Short sell: Federal Express (FDX 107.29) daily momentum hits new lows

Rational: The daily momentum of FDX has hit new lows and appears poised to swing lower from these levels. This chart displays a classic technical pattern, a bearflag, whereby the stock holds temporarily then surges downward another leg. Previous daily support held in the 100's. ADX numbers confirm a downward trending pattern.

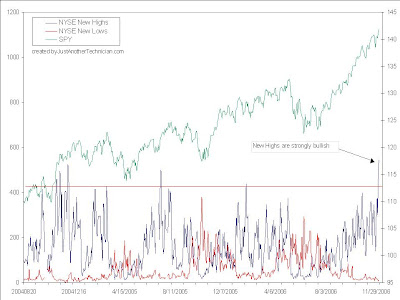

Transport stocks has been a source of concern since the Transport averages have diverged lower while the Dow has been hitting new highs. In Dow Theory, this non-confirmation of the Dow Industrials can often have forecasting value signaling intermediate weakening of the overall market.

Target: $100 area

Buy Stop: $109.25